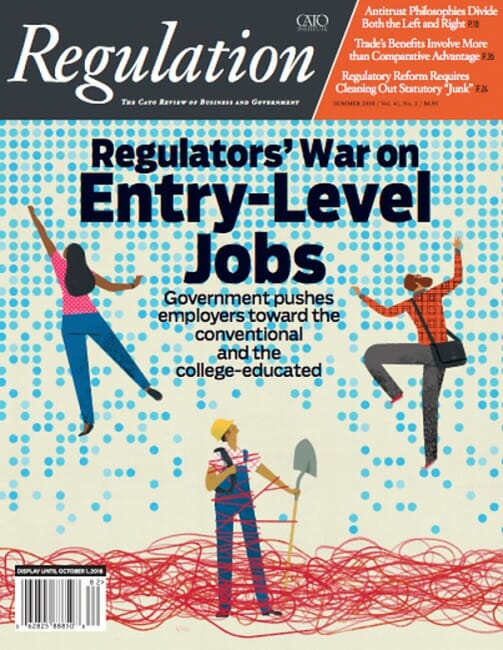

I have written the cover story for the Summer 2018 issue of Regulation magazine, titled "How Labor Regulation Harms Unskilled Workers." The link to the Summer 2018 issue is here and the article can be downloaded as a pdf here. I meant to be a bit more prepared for this but it was originally slated for the Spring issue and it (rightly) got kicked to the later issue to add a more timely article on tariffs and trade. The summer publication date sort of snuck up on me until I saw that Walter Olson linked it.

FAQ (I will keep adding to this as I get questions)

How did a random non-academic dude get published in a magazine for policy wonks? This piece started well over a year ago, back when my friend Brink Lindsey was still at Cato (he has since moved to the Niskanen Center). I had told him once that I was spending so much of my personal time responding to regulatory changes affecting my company that I had little time to actually focus on improving my business. I joked that we were approaching the regulatory singularity when regulations were added faster than I could comply with them.

Brink asked that I write something on small business and regulation. After about 10 minutes staring at a blank document in Word, I realized that was way too broad a topic. I decided that the one area I knew well, at least in terms of compliance costs, was labor regulation. After some work, I eventually narrowed that to the final topic, the effect (from a business owner's perspective who had to manage compliance) of labor regulation on unskilled labor.

Once I finished, I was ready to just give up and publish the piece on my blog. I sent it to Brink but told him I thought it was way too rough for publication. He told me that he had seen many good published pieces that looked far worse in their early drafts, so I buckled down and cleaned it up. My editor at Regulation took on the heroic task of getting the original monstrosity tightened down to something about half the length. As with most good editing processes, the piece was much better with half the words gone.

The real turning point for me was advice I got from Walter Olson of Cato. I "know" Walter purely from blogging but I love his work and had been a substitute blogger at Overlawyered in its early years. At one point, I was really struggling with this article because I kept feeling the need to address the broader viability of the minimum wage and the academic literature that surrounds it. But I am not an academic, and I have not done the research and I was not even familiar with the full body of literature on the subject. Walter's advice boiled down to the age-old adage of "write what you know." He encouraged me to focus narrowly on how a business has to respond to labor regulation, and how these responses might effect the employment and advancement prospects of unskilled workers. As such, then, the paper evolved away from a comprehensive evaluation of minimum wages as a policy choice (a topic I have opinions about but I don't have the skills to publish on) into a (useful, I think) review of one aspect of minimum wage policy, a contribution to the discussion, so to speak.

Update: Eek, I forgot since I started this so long ago. I also owe a debt of gratitude to about 8 of our blog readers who own businesses and volunteered to be interviewed for this article so I could make sure I was being comprehensive.

There are many positive (or negative) aspects of labor regulation you have excluded! Yes, as discussed above this paper is aimed narrowly at one aspect of labor regulations -- understanding how businesses that employ unskilled workers respond to these regulations and how those responses affect workers and their employment and advancement prospects

Everyone knows employer monopsony power means there are no employment or price effects to minimum wage increases. Some studies claim to have proved this, others dispute this. I would say that this statement has always seemed insane from my perspective as a small business owner. It sure doesn't feel like I have a power imbalance in my favor with my workers. I address this with a real example in the article but also address it in much more depth here. The short answer is that for minimum wages to have no employment or price effects, a company has to have both monopsony power in the labor market AND monopoly power in its customer markets. Without the latter, all gains from "underpaying" a worker due to monopsony power get competed away and benefit consumers (in the form of lower prices) rather than increase a company's profit.

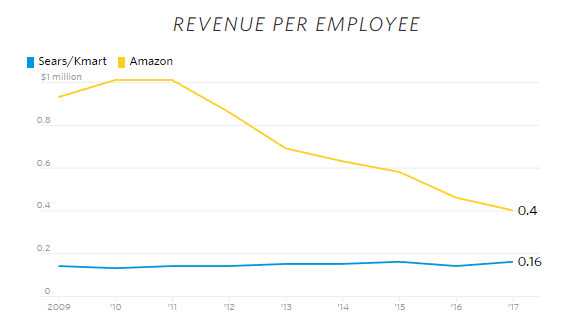

The costs of these regulations are supposed to come out of your bloated profits. Perhaps that is what happens at Google, where compliance costs are a tiny percentage of what their highly-compensated employees earn and where the company enjoys monopoly profits in its core businesses. For those of us in highly-competitive businesses that employ unskilled workers, our profit margins are really thin (as explained in more depth here). When profits are close to the minimum that supports further investment and participation in the business, then labor regulatory costs are going to get paid by consumers and workers.

Then maybe the best thing for workers is to create monopolies. Funny enough, this idea was actually one of the centerpieces of Mussolini's corporatist economic model, a model that was copied approvingly by FDR in the centerpiece New Deal legislation the National Industrial Recovery Act (NRA). The NRA sought to create cartels in major industries that would fix prices, wages, and working conditions, among other things. The Supreme Court struck the legislation down, a good thing since it would have been a disaster for consumers and for innovation and probably for most workers too. As a bit of trivia, this year's Superbowl winner the Philadelphia Eagles was named in honor of this law. More here.

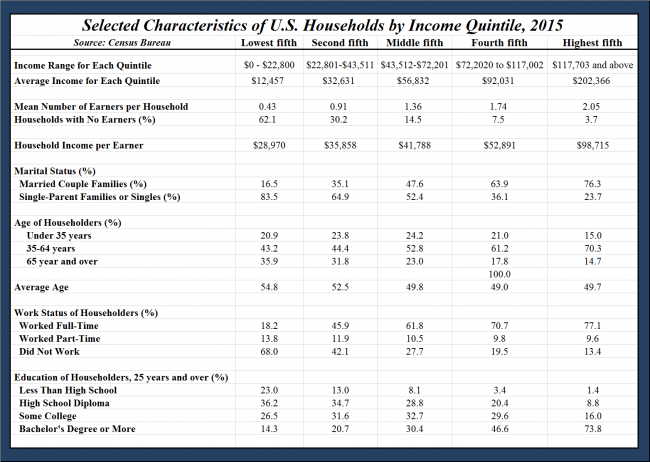

So do you think minimum wages are a good policy overall or not? Hmm, mostly not. For a variety of reasons, minimum wages are a very inefficient way to tackle poverty (and also here), and tend to have cronyist effects that help one class of worker at the expense of other classes (this latter should be unsurprising since many original supporters of the first federal minimum wages were explicitly hoping to disadvantage black workers competing with whites).

Why are you opposed to all these worker protections? Or, more directly, why do you hate workers? This is silly -- I am not and I don't. However, this sort of critique, which you can find in the comments below, is typical of how public policy discussion is broken nowadays. When I grew up, public policy discussion meant projecting the benefits of a policy and balancing them against the costs and unintended consequences. In this context, I am merely attempting to air some of the costs of these regulations for unskilled workers that are not often discussed. Nowadays, however, public policy is judged solely on its intentions. If a law is intended to help workers (whether or not it will every reasonably achieve its objectives), then it is good, and anyone who opposed this law has bad intentions. This is what you see in public policy debates all the time -- not arguments about the logic of a law itself but arguments that the opposition are bad people with bad intentions. For example, just look in the comments of this and other posts I have linked -- because Coyote points out underappreciated costs to laws that are intended to help workers, his intentions must be to harm workers. It is grossly illogical but characteristic of our post-modernistic age.

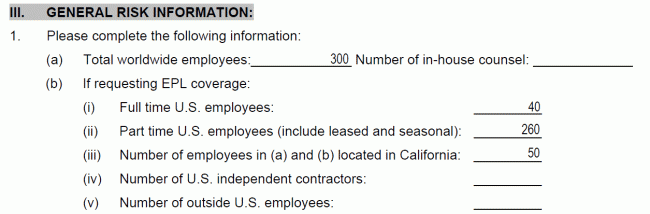

I will retell a story about Obamacare or the PPACA. Most of my employees are over 60 and qualify for Medicare. As such, no private insurer will write a policy for them -- why should they? Well, along comes Obamacare, and it says that my business has to pay a $2000-$3000 penalty for every employee who is not offered health insurance, and Medicare does not count! I was in a position of paying nearly a million dollars in fines (many times my annual profits) for not providing insurance coverage to my over-60 employees that was impossible to obtain -- we were facing bankruptcy and the loss of everything I own. The only way out we had was that this penalty only applied to full-time workers, so we were forced to reduce everyone's hours to make them all part-time. It is a real flaw in the PPACA that caused real harm to our workers. Do I hate workers and hope they all get sick and die just because I point out this flaw with the PPACA and its unintended consequence?

I've heard that raising the minimum wage increases worker productivity so much that businesses are better off. I know there is academic literature on this and I am frankly just not that familiar with it. I can say that I have never, ever seen workers suddenly and sustainably work harder after getting a wage increase. What I see instead is employers doing things like cutting back employee hours and demanding the same amount of work gets done. This could result in more productivity if there was fat in the system beforehand but it also can result in things like lower service levels (e.g. the bathrooms get cleaned less frequently). Without careful measurement, these changes could appear to an outsider to be productivity gains. In addition, as discussed in the article, with higher minimum wages employers can substitute more skilled for less skilled workers, which can result in productivity gains but leave unskilled workers without a job.

Workers are human beings. It is wrong to think of them as "costs" or "resources". The most surprised I think I have ever been on my blog is when I got so much negative feedback for writing that the best thing that could happen to unskilled workers is for someone to figure out how to make a fortune hiring them. I thought this was absolutely obvious, but the statement was criticized as being heartless and exploitative. My workers are my friends and are sometimes like family. I hire hundreds of people over 60 years of age, people that the rest of society casts aside as no longer useful. They take pride in their ability to continue to be productive. You don't have to tell me they are human beings. Just this week I have helped modify an employee's job responsibilities to help them manage their newly diagnosed MS, found temporary coverage for a manager who needs to get to a relative's funeral, found a replacement for a manager that wants to take a sabbatical, and loaned two different employees money to help them through some tough financial times. From a self-interested point of view, I need my employees to be happy and satisfied in their work or they will provide bad, grumpy service. But at the end of the day I can only keep these people employed if customers are willing to pay more for the services they provide than the employees cost me. If the cost of employing people goes up, then either customers have to pay more or I can hire fewer employees.

You probably support child labor too. Child labor laws are an entirely reasonable zone of government regulation. The reason this is true stems from the definition of a child -- a child is someone considered under the law to lack agency or the ability to make adult decisions due to their age. We generally give parents, rightly, a lot of the responsibility for protecting their children from bad decisions, but I am fine with the government backstopping this with modest regulations. In other words, I have no problem with the law treating children like children. Instead, I have a problem with the law treating adults like children.

Aren't you just begging to get audited? Hah! That's what my wife says. To me, the logical response of a regulator should be, "wow, this guy knows the law way better than most of the business folks we deal with, so he probably is not a compliance risk" -- but you never know. Actually, we have been audited many times on many of these laws. So much so that practically the first series of posts I did on this blog, way back in the blog pleistocene era of 2004, was 3 part series on surviving a Department of Labor audit. Looking back on the series, everything in it (which included experience from a number of different audits) still seems valid and timely.