Don Boudreaux and and Mark Perry have been doing a great job making the case against Trump's trade sanctions. But it is always a danger only to learn about opposing views from those who disagree with you, so in the spirit of Bryan Caplan's "Ideological Touring Test" I wanted to address directly some of the arguments in support of Trump's sanctions.

I followed several links to this article by Spencer Morrison. After reading the whole thing, I fear I have made the intellectual error of choosing a poor representative of the opposing side's argument, but I am committed now, so here goes.

Consider that China steals more than half a trillion dollars in American intellectual property every single year. This is one of the reasons America’s trade deficit with China is so massive. For example, in 2010 Chinese companies stole high-speed rail designs from American firms, thereby depriving them of hundreds of billions in potential revenues. Such theft occurs in nearly every industry, whether it’s software programs or branded consumer goods. And the worst part? We let it happen.

I find the author's figure absurd, and likely untrustworthy given his example. Following his high-speed rail design "theft" link one quickly finds that 1) Americans were not involved at all, which is not surprising since we really don't have high-speed rail manufacturing industry or expertise in this country; 2) the technology seems to have been acquired or copied legally; and 3) the real competitive issue for non-Chinese companies seems to be that the Chinese have extended and improved the technology.

This one paragraph essentially summarized the theme of the article, that technology is the key to increased well-being and that the US is poorer when they cannot monopolize the best technology. The first is true, the second is dead wrong and flies in the face of 200 years of history.

I won't spend time on the mass of the article where describes the economy in very production-based terms which I don't totally agree with, but his basic point is one I can partially accept -- that real economic growth over time comes from productivity growth. I agree that technology is part of the productivity equation, but unlike the author I also see other drivers such as trade (which he calls "noise"). Trade is a critical factor in productivity improvement as specialization and comparative advantage greatly increase productivity.

But where I think he really goes off the rails is to say that because technology is wealth-creating, we need to monopolize that technology in the US.

The core issue remains: we continue to offshore our advanced industries at an alarming pace, which will only increase the likelihood that the “next big thing” will be invented abroad. If we do not reverse this trend, we will soon be on the outside looking in.

It would be entertaining to discuss the origins of the American textile industry in the late 18th and early 19th century with the author, which were largely based on spinning jenny and powerloom designs that were literally stolen from manufacturers in the UK (countries don't own technologies, only individuals and their companies do). The UK at the time had strict technology export restrictions of which I am sure the author would have been approving.

So did the UK suddenly become poorer as America built a lively cloth industry? No, in fact the UK boomed along with the US. It turns out that spreading new technology and productivity techniques around more widely made everyone richer. This only makes sense. Would the West really be wealthier if they had kept all technology from spreading, and thus were surrounded by countries dominated by subsistence farming and medieval crafts? A skeptic might argue that the UK did eventually become poorer relative to the US and upstart Germany, but Andrew Carnegie could have told you why at the beginning of the 20th century. He went back and toured manufacturers in his old home and was horrified at how little they reinvested in new technology.

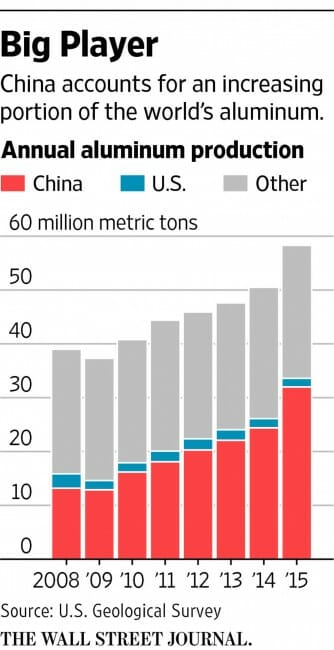

Which brings me back to Chinese high speed rail, the example he started with. Clearly the Chinese have a growing high-speed rail manufacturing industry, and they DIDN'T invent the technologies originally in China. This is what trade is all about. Rather than keep technologies locked up in a secret underground bunker in the Rockies, as the author seems to prefer, it spreads technologies around the world. Production then shifts around the world based on a variety of factors such as comparative advantage in ways that are hard to predict, but seldom has a strong relationship to the country in which the technology was first invented. One place production does NOT shift, though, is towards countries whose government has artificially raised critical raw material prices through border taxes on its consumers called tariffs.

Which reminds me, if the problem is China "stealing" things like high-speed rail technology, then why in the hell are we imposing steel and aluminum tariffs? What the heck does this have to do with technology transfer? In fact, if the US really had a high-speed rail industry we were worried about, or if one were exclusively concerned with the auto industry, the author is essentially telling them "we are sorry you had your technology stolen so to help you out we going to substantially raise the prices of your two largest purchases (steel and aluminum) so that you can be even less competitive internationally." Ahh, I can feel the economic growth from that already.

If the author wants better intellectual property protections for US companies and individuals, I am generally supportive of efforts to achieve this (as long as we don't over-specify intellectual property and end up again with endless patent troll suits). For all its flaws, though, joining the TPP seems to be a better path to this end (it actually addresses, you know, intellectual property protections rather than just raise steel prices for consumers).

To conclude, I love this quote from his article because, despite being anti-trade, he in fact is echoing the pro-trade observation by Steven Landsburg.

Yet our trade policy does exactly the opposite. After the North American Free Trade Agreement took effect in 1994, U.S. corn exports surged, as did our imports of automobiles. The problem is that automobile manufacturing is much more likely to benefit from disruptive technology than is growing corn—under NAFTA, the preponderance of long-run benefits went to Mexico, not the United States. The same is true with America’s trade relationship with China: America’s advanced goods trade deficit with China now tops $120 billion. Meanwhile, our biggest export is soybeans.

Free trade is, quite literally, turning America into China’s mercantile resource colony: we buy their value-added, manufactured products, and we sell them raw materials.

This is freaking awesome! We grow and sell soybeans and get back advanced technology products. Brilliant! No wonder we are the richest nation on Earth.

Postscript: So to save the time clicking through to Steven Landsburg, here is a part of what he said (via Carpe Diem):

There are two technologies for producing automobiles in America. One is to manufacture them in Detroit, and the other is to grow them in Iowa. Everybody knows about the first technology; let me tell you about the second. First you plant seeds, which are the raw material from which automobiles are constructed. You wait a few months until wheat appears. Then you harvest the wheat, load it onto ships, and sail the ships eastward into the Pacific Ocean. After a few months, the ships reappear with Toyotas on them.

International trade is nothing but a form of technology. The fact that there is a place called Japan, with people and factories, is quite irrelevant to Americans’ well-being. To analyze trade policies, we might as well assume that Japan is a giant machine with mysterious inner workings that convert wheat into cars. Any policy designed to favor the first American technology over the second is a policy designed to favor American auto producers in Detroit over American auto producers in Iowa. A tax or a ban on “imported” automobiles is a tax or a ban on Iowa-grown automobiles. If you protect Detroit carmakers from competition, then you must damage Iowa farmers, because Iowa farmers are the competition.

The task of producing a given fleet of cars can be allocated between Detroit and Iowa in a variety of ways. A competitive price system selects that allocation that minimizes the total production cost. It would be unnecessarily expensive to manufacture all cars in Detroit, unnecessarily expensive to grow all cars in Iowa, and unnecessarily expensive to use the two production processes in anything other than the natural ratio that emerges as a result of competition.

That means that protection for Detroit does more than just transfer income from farmers to autoworkers. It also raises the total cost of providing Americans with a given number of automobiles. The efficiency loss comes with no offsetting gain; it impoverishes the nation as a whole.