Mike Rizzo writes:

A typical sovereign government can secure funds from three “legitimate” places.*What are these sources?

- Taxes today.

- Taxes tomorrow. In other words we can borrow money today in order to build our bridge and then use future tax revenues to pay for the debt tomorrow. By the way, if the government is in the business of actually producing valuable “public goods” then you can easily think of this as value enhancing.

- Printing money. It’s not generally done this way, but in effect the monetary authorities can monetize the borrowing of a sovereign entity (how they do it is beyond the scope of this post). For simplicity, imagine instead that a central bank prints new bank notes from scratch, hands them to the Treasury, and then the Treasury spends them on goods and services. This is just another form of a tax, again beyond the scope of this post.

So, this is what the government budget identity looks like for “normal” countries:

G = T + the change in debt + the change in base money

I think this is a useful simplification, but I wanted to add a couple other refinements (refinements by the way he did not neglect in his text, just did not put in the formula). One other source of funds we have seen in Greece is what I would call Aid, which used to be humanitarian aid (think India in the 1970s) but today tends to be bailout money and debt forgiveness. So we will write the equation

G = Taxes + ΔDebt + Money Printing + Aid

But due to the Keynesian orientation of many commenters on the Greek and European situation, it becomes useful to expand the "taxes" term into some sort of base income, which I will just call GDP for simplicity, and some sort of tax rate t. So then we get:

G = GDP x t + ΔDebt + Money Printing + Aid

The Greeks can't print money (unless the EU does it for them) and at the moment no one in their right mind will lend to them without guarantees from stronger European countries (e.g. Germany). If we call EU money printing for Greece or EU loan guarantee programs Aid, we get

G = GDP x t + Aid

As Rizzo noted, aid is drying up and Greek tax revenues are going down rather than up, so basically they are screwed. The only out seems to be for Greece to exit the Euro and then, once on the drachma again, print money like crazy and inflate their way out of the debt.

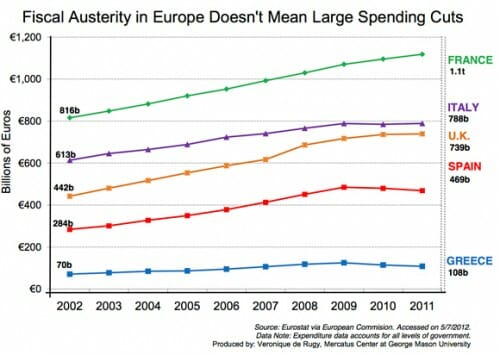

But expanding the tax term reveals one more policy alternative that is being suggested. Keynesians seem to believe there is a path out of this situation in Greece (or if Greece is too far gone, certainly in Italy and Spain) where money from some source (aid, borrowing, whatever) is spent in the economy by the government in some way that is stimulative, thus increasing GDP and therefore taxes and allowing Greece to increase the money available to the government. Since Aid is currently only be granted tied to "austerity" programs rather than stimulative spending, they feel Germany et al are following exactly the wrong course.

I am incredibly skeptical of this for two reasons, beyond just my general skepticism of Keynesian stimulus. First, I have heard something akin to this in my personal experience. For a short time in my life, during the Internet crazy period, I was brought in by some investors to look at their portfolio of languishing Internet plays (e.g. discountshoelaces.com)* and decide if they should keep pouring money in or shut down. The plan I got from management was always - always - this stimulus approach. They suggested that rather than cut back, the investors should give them a bunch of new money to really blow out the marketing effort, which would kick start their growth, etc. etc.

The problem was that they never, ever had a lick of evidence beyond just hope that the next $1 million would suddenly do what the last $10 million failed to do. So we shut most of these efforts down. Your first loss is your best loss, as they say.

Similarly, I don't think Keynesians can point to any example in history where this actually worked. A country is drowning in debt, but suddenly a Hail Mary play of adding a huge chunk more to the debt and spending it on civil service worker salaries suddenly turned the tide. Seriously, do people honestly think this will work? Or are they just frustrated because they grew up with an assumption that there is always a public policy answer for everything and there just does not seem to be one here.

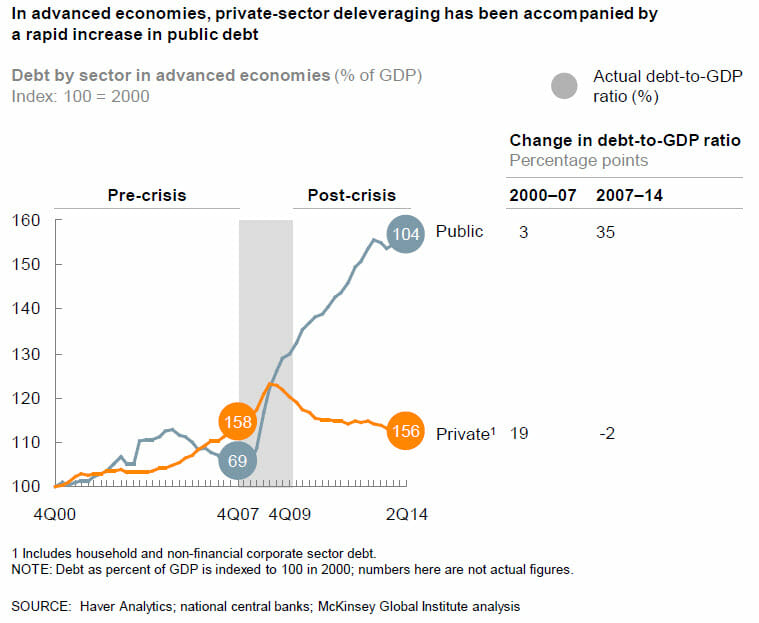

I have an emerging hypothesis, not backed by any evidence at this point, that the value of the Keynesian multiplier shifts as debt to total GDP increases. I am not sure in actual practice it is ever above one, but if it were to be above 1 at 20% debt to GDP, it certainly is not going to be the same at, say, 150%.