Most of us who took Econ 101 would expect that an increase in the minimum wage would increase unemployment, at least among low-skilled and younger workers most affected by the minimum wage. After all, demand curves slope downwards so that an increase in price of labor should result in a decrease in demand for that labor.

There is a great body of work on employment effects of minimum wage, and surveying this corpus is beyond the scope of this paper, but a good starting point might be the recent detailed and careful study by Jardim et. al. of the University of Washington, which analyzed the employment effects of the increase in minimum wages in Seattle from $11 to $13. They found that while average hourly wages for lower-paid workers went up by 3%, the total hours worked went down by 9%, resulting in a net reduction in total wages for lower-paid, lower-skill workers at the same time that other sectors of the Seattle economy were booming.

Monopsony Power & The Labor Market

Supporters of the minimum wage, however, argue that these employment effects are exaggerated, because employers have something called monopsony power when hiring low-skill workers. What a monopoly is to customers – it limits choices – a monopsony does to suppliers, in this case the suppliers of labor. The argument is that due to a bargaining power imbalance, employers can hire workers for less than they would be willing to pay in a truly competitive market, gaining the company added savings that increase its profits. Under this theory, minimum wage laws help to offset this power imbalance and force companies to disgorge some of their excess profits in favor of higher wages. If this assumption is true, then demand for labor would not be reduced due to a minimum wage increase because, prior to the wage increase, companies were paying less than they were willing to pay and thus are still willing to continue to pay the wages at the new higher rates.

While economists argue about this monopsony theory, my intuition as an employer makes me skeptical. However, rather than argue about whether my little company that scrambles to staff itself every year somehow wields excess power in the labor markets, I am going to argue that the existence of monopsony power is irrelevant to the employment effects of a minimum wage increase: Even if companies are able to pay workers less than they might via such bargaining power imbalances, whatever gains they reap from workers will end up in consumer hands. As a result, minimum wage increases still must result either in employment reductions or consumer price increases or more likely both.

Why? Well, we need to back up and do a bit of business theory. Just as macroeconomics (all the way back to Adam Smith) spends a lot of time thinking about why some countries are rich and some are poor, business theory spends a lot of time trying to figure out why some firms are profitable and some are not. One of the seminal works in this area was Michael Porter's Five Forces model, where he outlines five characteristics of markets and firms that tend to drive profitability. We won't go into them all, but the most important of the forces for us (and likely for Porter) is the threat of new entrants -- how easy or hard is it for new firms to enter the marketplace and begin competing against an incumbent firm? If new companies can enter into competition easily, a profitable firm will simply attract new competitors, and keep attracting them until the returns in that market are competed down to some minimum level.

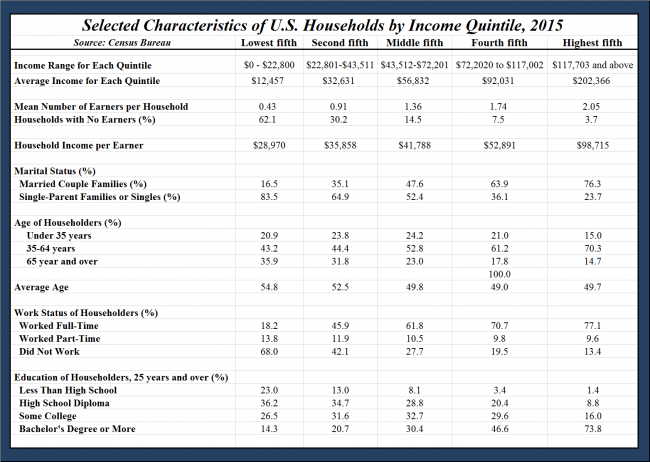

Let’s consider a company paying minimum wage to most of its employees. At least at current minimum wage levels, minimum wage employees will likely be in low-skill positions, ones that require little beyond a high school education. Almost by definition, firms that depend on low-skill workers to deliver their product or service have difficulty establishing barriers to competition. One can’t be doing anything particularly tricky or hard to copy relying on workers with limited skills. As soon as one firm demonstrates there is money to be made using low-skill workers in a certain way, it is far too easy to copy that model. As a result, most businesses that hire low-skill workers will have had their margins competed down to the lowest tolerable level. Firms that rely mainly on low-skill workers almost all have single digit profit margins probably averaging around 5% of revenues (for comparison, last year Microsoft had a pre-tax net income margin of over 23%).

If there were some margin windfall to be obtained from labor market power that allowed a company to hire people for far less than their labor was worth to it, and thus earn well above this lowest tolerable margin, new companies would try to enter the market, probably by lowering prices to consumers using some of that labor premium. Eventually, even if the monopsony premium exists, it is given away to consumers in the form of lower prices. If the wholesale price of gasoline suddenly falls sharply, gasoline retailers don't get to earn a much higher margin, at least not for very long. Competition quickly causes the retailer's lowered costs to be passed on to consumers in the form of lower retail prices. The same goes for any lowering of labor costs due to monopsony power -- if such a windfall exists, it is quickly passed on to consumers.

As a result, the least likely response to increasing labor costs due to regulation is that such costs will be offset out of profits, because for most of these firms, profits have already been competed down to the minimum necessary to cover capital investment and the minimum returns to keep owners interested in the business. The much more likely responses will be:

- Raising prices to cover the increased costs. While competitors that are subject to the same laws will likely have similar increases, the increase may not be acceptable to consumers and almost certainly will result in some loss in unit sales.

- Reducing employment. There are a variety of ways in which a minimum wage increase could result in employment losses. A company might raise its prices to compensate for higher costs, only to find its unit volumes falling, necessitating a layoff in staff. Or the staff reductions may also be due to targeted technology investments, as increases in labor costs also increase the returns to investments in capital equipment that substitutes for labor

- Exiting one or more businesses and laying everyone off. This may take the form of exiting a few selected low-margin lines of business, or liquidation of the entire company if the business is no longer viable with the higher labor costs.

A Real-World Minimum Wage Increase Example

A concrete example should help. Imagine a service business that relies mainly on minimum wage employees in which wages and other labor related costs (payroll taxes, workers compensation, etc.) constitute about 50% of the company’s revenues. Imagine another 45% of company revenues going towards covering fixed costs, leaving 5% of revenues as profit. This is a very typical cost breakdown, and in fact is close to that of my own business. The 5% profit margin is likely the minimum required to support capital spending and to keep the owners of the company interested in retaining their investment in this business.

Now, imagine that the required minimum wage rises from $10 to $15 (exactly the increase we are in the middle of in places like Seattle and California). This will, all things equal, increase our example company's total wage bill by 50%. With the higher minimum wage, the company will be paying not 50% but 75% of its revenues to wages. Fixed costs will still be 45% of revenues, so now profits have shifted from 5% of revenues to a loss of 20% of revenues. This is why I tell folks the math of supposedly absorbing the wage increase in profits is often not even close. Even if the company were to choose to become a non-profit charity outfit and work for no profit, barely a fifth of this minimum wage increase in this case could be absorbed. Something else has to give -- it is simply math.

The absolute best case scenario for the business is that it can raise its prices 25% without any loss in volume. With this price increase, it will return to the same, minimum acceptable profit it was making before the regulation changed (profit in this case in absolute dollars -- the actual profit margin will be lowered to 4%). But note that this is a huge price increase. It is likely that some customers will stop buying, or buy less, at the new higher prices. If we assume the company loses 1% of unit volume for every 2% price increase, we find that the company now will have to raise prices 36% to stay even given both the minimum wage increase and the lost volume. Under this scenario, the company would lose 18% of its unit sales and is assumed to reduce employee hours by the same amount.

In the short term, just for the company to survive, this minimum wage increase leads to a substantial price increase and a layoff of nearly 20% of the workers. Of course, in real life there are other choices. For example, rather than raise prices this much, companies may execute stealth price increases by laying off workers and reducing service levels for the same price (e.g. cleaning the bathroom less frequently in a restaurant). In the long-term, a 50% increase in wage rates will suddenly make a lot of labor-saving capital investments more viable, and companies will likely substitute capital for labor, reducing employment even further but keeping prices more stable for consumers.

As you can see, in our example we don’t need to know anything about bargaining power and the fairness of wages. Simple math tells us that the typical low-margin service business that employs low-skill workers is going to have to respond with a combination of price increases and job reductions.