Donald Mamdani Trump

President Trump said he will ban large investors from buying single-family homes, the administration’s first significant move to address the country’s severe housing shortage.

“I am immediately taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it. People live in homes, not corporations,” Trump said in a social-media post Wednesday.

I tell folks all the time that Trump is not a freaking free-marketeer. This is yet more evidence. His proposal is right out of the failed Progressive-Socialist playbook on housing. Some quick thoughts:

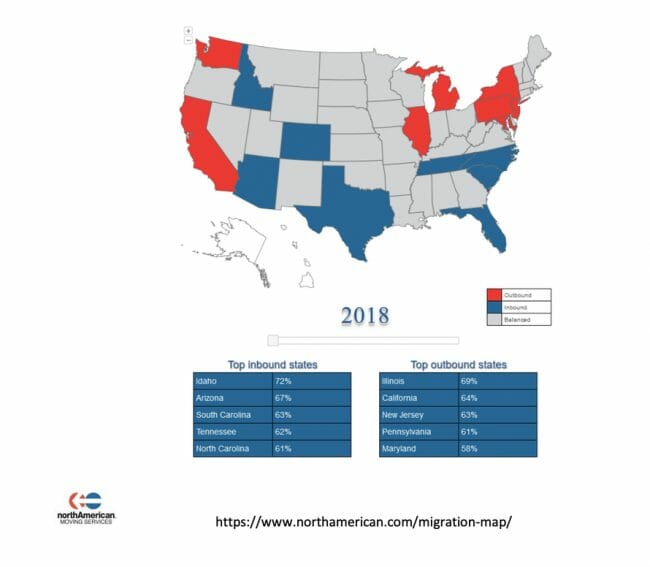

- Except where the houses have been converted to overnight rentals (think Airbnb or VRBO), people still live in these institutionally owned houses. This is not withdrawing housing stock from the market, it is merely shifting it from individual purchase to rentals. And there are arguments for there being more not less rental houses -- particularly when interest rates are high and/or housing prices are flat, houses limit mobility by locking a family to a fixed position, limiting the ability to seek out better employment in other cities

- There is something to be said for renting from an institution, rather than an individual owner, as these landlords have better systems, large support and maintenance staffs, and often better legal compliance. Because living in certain neighborhood boundaries is required to attend the best public schools, this allows families who could not afford to buy a house in that neighborhood to be able to live there. It also opens suburban living to young couples who have not yet saved a down payment.

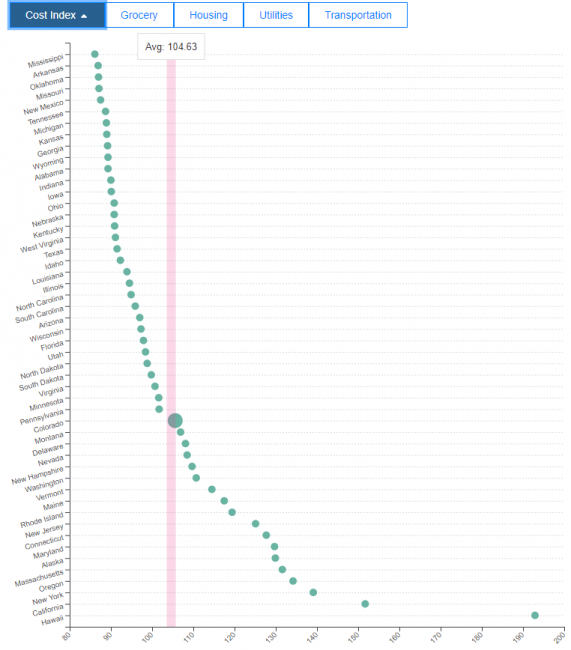

- According to the WSJ, these institutions own 2-3% of the housing stock at most. Hard to imagine that this tail is wagging the dog. This is a typical populist grandstanding proposal with zero ability to address the intended issue, but a lot of emotional resonance with swing voters.

- Real housing prices were likely flat to slightly down in 2025, so if there is a current "affordability" crisis it has more to do with higher mortgage rates than housing prices per se. Rents have increased faster than inflation the last several years, but its hard to figure how removing rental units from the market based on this order will do anything to lower rents.

- No one was complaining about institutional buyers back in 2008 when the market was awash in unsold houses and institutions began soaking up this excess capacity and providing much needed liquidity to the market.

- I will confess the endless calls and texts to my cell phone from these yahoos trying to buy my house does piss me off, but not enough to ban their business model

- Fiddling with ownership rules will not do anything for housing affordability. The reason prices are rising is that there is not enough housing being built and has little or nothing to do with who owns the homes. Many cities have myriad restrictions on home construction -- from outright limitations on new building permits to growth boundaries to onerous permitting rules -- while at the same time we subsidize demand through government mortgage insurance and the most lenient mortgages in the Western world (the bank can only take your house, not your other property if you default). There remains much local support for housing restrictions -- you can think of many cities as a cartel of homeowners protecting their monopoly through restrictions on adding competing supply.

- There are two financial reasons people want to own rather than rent houses (beyond an array of emotional ones)

- Mortgage interest is deductible on taxes, rent is not. Why not equalize these, either by ending the deductibility of mortgage interest, or since that is likely a political non-starter, by making rent payments deductible?

- Historically home equity has been a good investment for many, with real home prices doubling over the past 50 or so years. Over this same period, someone with a 90% Loan-to-Value (LTV) would have seen a 10x increase on their 10% equity portion. As discussed above, this is mainly due to subsidizing demand and restricting supply. However, this only works when housing prices grow faster than inflation, which is what people are now complaining about. You can't have both -- either house prices rise faster than inflation and are a great investment or they don't and are more affordable but not a very good investment.

- There is no way the President should have the power to mandate this. Republicans are really, really going to regret these precedents when the next socialist-Democrat is in office and mandates something like national rent control.